Banks, investment firms and financial institutions in the EU must champion boardroom responsibility and their legal obligations to protecting clients when using AI, according to the EU securities watchdog in its first statement on AI.

The European Securities and Markets Authority (ESMA) set out how BFSIs regulated within the bloc’s 27 countries should use AI in their day-to-day operations without breaking the EU’s MiFiD securities law.

While AI holds significant promise in enhancing investment strategies and client services while reducing time spent on menial tasks, it also presents inherent risks that cannot be fully understood yet, the ESMA said.

“Importantly,” says ESMA, “firms’ decisions remain the responsibility of management bodies, irrespective of whether those decisions are taken by people or AI-based tools.”

The future of AI leadership

The statement doesn’t just cover instances where AI tools have been developed in-house or formally adopted by the bank itself, but also in cases where employees use third-party tools like ChatGPT or Gemini without the direct knowledge or approval from senior management.

And according to ESMA, the onus is on the C-suite to make that happen.

This sentimentality has been a big part of the US’ approach to AI safety, mandating the appointment of Chief AI Officers in federal institutions late last year. But hiring a CAIO may be harder than it sounds.

“CAIOs are a scarce and costly commodity,” said Waseem Ali, CEO of Rockborne. “We’re not seeing many on the market… but the ones we do see are working in fintechs and insurance firms.”

What’s next for AI in banking?

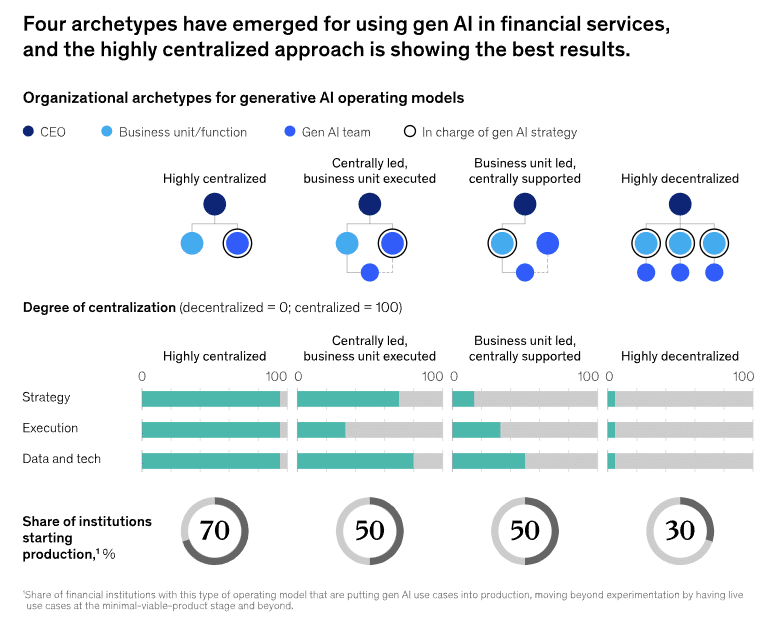

According to McKinsey, gen AI could add between $200 billion and $340 billion in value annually across the global banking sector – largely through increased productivity.

But there are risks that come with the corporate use of these tools that have been slowing the realisation of that value.

Conor Larkin, Senior Manager in Risk Analytics Recruitment at Harnham, says: ” Banks are investing heavily in AI to stay competitive, indicating strong industry commitment to technological advancement. But concerns about data privacy, potential biases in AI models, and regulatory challenges, provide some friction to the adoption of AI in this space.”

Without the right talent and strategy to correctly implement and utilise AI, the financial sector will be unable to fully reap the benefits of the technology.

For more information on risk analytics recruitment, reach out to Conor Larkin.

Take part in our 2024-25 Data & AI Salary Survey today for five chances of winning £100/€100/$100! Start HERE.